Source: Air Canada

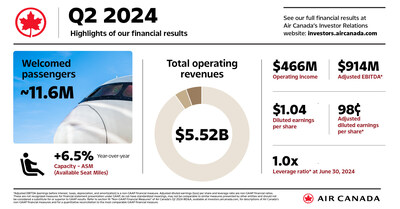

- Second quarter operating revenues of $5.5 billion, increased 2% year over year

- Operating income of $466 million, decreased $336 million year over year

- Adjusted EBITDA* of $914 million, decreased $306 million year over year

- Leverage ratio* of 1.0 as at June 30, 2024, compared to 1.1 at end of 2023

Air Canada today reported its second quarter 2024 financial results.

“Air Canada today reported second quarter operating revenues of more than $5.5 billion and adjusted EBITDA of $914 million. We saw healthy demand, with load factors remaining above historical averages. We remained sharply focused on our customers and operations throughout the quarter and experienced a 10-percentage point year-over-year improvement in our on-time performance, even with the increased flying. I thank our employees for their hard work in safely transporting 11.6 million customers in the quarter and I am pleased to see their efforts recognized as we were ranked the best airline in Canada and received five honours at the Skytrax 2024 World Airline Awards, the most of any Canadian carrier,” said Michael Rousseau, President and Chief Executive Officer of Air Canada.

“When compared to the second quarter of 2023, we increased our capacity 6.5 per cent in the period. Our adjusted unit cost was well contained, increasing 1.7 per cent. This was supported through rigorous cost discipline, which is always a top priority for us. We will continue to adapt to market conditions, manage capacity proactively and contain costs through productivity and other initiatives.

We further diversified our network, including with services to Singapore, Stockholm and India, and enhanced our operational flexibility by securing an additional eight Boeing 737-8 aircraft, set to enter service next year. These actions reaffirm our dedication to our customers, whom I thank for their continued loyalty. We are proud of our role as Canada’s leading global airline, connecting Canada to the world.”

| *Adjusted CASM, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted EBITDA margin, leverage ratio, net debt, adjusted pre-tax income (loss), adjusted net income (loss), adjusted earnings (loss) per share, and free cash flow are referred to in this news release. Such measures are non-GAAP financial measures, non-GAAP ratios, or supplementary financial measures, are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results. Refer to the “Non-GAAP Financial Measures” section of this news release for descriptions of these measures, and for a reconciliation of Air Canada non-GAAP measures used in this news release to the most comparable GAAP financial measure. |

Second Quarter 2024 Financial Results

The following is an overview of Air Canada’s results of operations and financial position for the second quarter 2024 compared to the second quarter 2023.

- Operating revenues of $5.519 billion increased $92 million or 2% on 6.5% more operated capacity. The year-over-year capacity increase was in line the projection provided in Air Canada’s May 2, 2024, news release.

- Operating expenses of $5.053 billion increased $428 million or 9%.

- Operating income of $466 million, with an operating margin of 8.4%, decreased $336 million.

- Adjusted EBITDA of $914 million, with an adjusted EBITDA margin of 16.6%, declined $306 million.

- Net income of $410 million or $1.04 diluted earnings per share, compared to $838 million or $2.34respectively.

- Adjusted net income of $369 million or $0.98 adjusted earnings per diluted share, compared to $664 million or $1.85 respectively.

- Adjusted CASM of 13.53 cents increased 1.7% year-over-year, driven by labour, maintenance and information technology expenses increasing at a higher rate than capacity.

- Net cash flows from operating activities of $924 million, decreased $566 million.

- Free cash flow* of $451 million, decreased $514 million.

- Net debt-to-adjusted EBITDA ratio was 1.0 at June 30, 2024, compared to 1.1 at December 31, 2023.

Outlook

For the third quarter of 2024, Air Canada plans to increase its ASM capacity between 4% and 4.5% from the same quarter in 2023.

For the full year 2024, Air Canada is confirming the following guidance, which was updated on July 22, 2024:

| Metric | 2024 Guidance |

| ASM capacity | 5.5 to 6.5% increase versus 2023 |

| Adjusted CASM | 2.5 to 3.5% increase versus 2023 |

| Adjusted EBITDA | $3.1 to $3.4 billion |

Major Assumptions

Air Canada made assumptions in providing its guidance—including moderate Canadian GDP growth for 2024. Air Canada also assumes that the Canadian dollar will trade, on average, at C$1.36 per U.S. dollar for the full year 2024 and that the price of jet fuel will average C$1.03 per litre for the full year 2024.

Non-GAAP Financial Measures

Below is a description of certain non-GAAP financial measures and ratios used by Air Canada to provide readers with additional information on its financial and operating performance. Such measures are not recognized measures for financial statement presentation under GAAP, do not have standardized meanings, may not be comparable to similar measures presented by other entities and should not be considered a substitute for or superior to GAAP results.

Air Canada excludes the effect of impairment of assets, if any, when calculating adjusted CASM, adjusted EBITDA, adjusted EBITDA margin, adjusted pre-tax income (loss) and adjusted net income (loss) as it may distort the analysis of certain business trends and render comparative analysis across periods or to other airlines less meaningful. Air Canada did not record charges for impairment of assets in the first six months of 2024 or in 2023.

Adjusted CASM

Air Canada uses adjusted CASM to assess the operating and cost performance of its ongoing airline business without the effects of aircraft fuel expense, the cost of ground packages at Air Canada Vacations and freighter costs as these items may distort the analysis of certain business trends and render comparative analysis across periods less meaningful and their exclusion generally allows for a more meaningful analysis of Air Canada’s operating expense performance and a more meaningful comparison to that of other airlines.

In calculating adjusted CASM, aircraft fuel expense is excluded from operating expense results as it fluctuates widely depending on many factors, including international market conditions, geopolitical events, jet fuel refining costs and Canada/U.S. currency exchange rates. Air Canada also incurs expenses related to ground packages at Air Canada Vacations which some airlines, without comparable tour operator businesses, may not incur. In addition, these costs do not generate ASMs and therefore excluding these costs from operating expense results provides for a more meaningful comparison across periods when such costs may vary.

Air Canada also incurs expenses related to the operation of freighter aircraft which some airlines, without comparable cargo businesses, may not incur. Air Canada had six Boeing 767 dedicated freighter aircraft in service as at June 30, 2024 and six as at June 30, 2023. These costs do not generate ASMs and therefore excluding these costs from operating expense results provides for a more meaningful comparison of the passenger airline business across periods.

Adjusted CASM is reconciled to GAAP operating expense as follows:

| (Canadian dollars in millions, except where indicated) |

Second Quarter | First Six Months | ||||||||||

| 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||

| Operating expense – GAAP | $ | 5,053 | $ | 4,625 | $ | 428 | $ | 10,268 | $ | 9,529 | $ | 739 |

| Adjusted for: | ||||||||||||

| Aircraft fuel | (1,333) | (1,187) | (146) | (2,587) | (2,562) | (25) | ||||||

| Ground package costs | (137) | (126) | (11) | (472) | (444) | (28) | ||||||

| Freighter costs (excluding fuel) | (38) | (39) | 1 | (73) | (70) | (3) | ||||||

| Operating expense, adjusted for the above-noted items |

$ | 3,545 | $ | 3,273 | $ | 272 | 7,136 | 6,453 | 683 | |||

| ASMs (millions) | 26,203 | 24,606 | 6.5 % | 50,540 | 46,513 | 8.7 % | ||||||

| Adjusted CASM (cents) | ¢ | 13.53 | ¢ | 13.30 | ¢ | 0.23 | ¢ | 14.12 | ¢ | 13.87 | ¢ | 0.25 |

EBITDA and Adjusted EBITDA

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) is commonly used in the airline industry and is used by Air Canada as a means to view operating results before interest, taxes, depreciation and amortization as these costs can vary significantly among airlines due to differences in the way airlines finance their aircraft and other assets.

Adjusted EBITDA margin (adjusted EBITDA as a percentage of operating revenues) is commonly used in the airline industry and is used by Air Canada as a means to measure the operating margin before interest, taxes, depreciation and amortization as these costs can vary significantly among airlines due to differences in the way airlines finance their aircraft and other assets.

Adjusted EBITDA and adjusted EBITDA margin are reconciled to GAAP operating income (loss) as follows:

| Second Quarter | First Six Months | |||||||||||

| (Canadian dollars in millions, except where indicated) |

2024 | 2023 | Change | 2024 | 2023 | Change | ||||||

| Operating income – GAAP | $ | 466 | $ | 802 | $ | (336) | $ | 477 | $ | 785 | $ | (308) |

| Add back: | ||||||||||||

| Depreciation and amortization | 448 | 418 | 30 | 890 | 846 | 44 | ||||||

| Adjusted EBITDA | $ | 914 | $ | 1,220 | $ | (306) | $ | 1,367 | $ | 1,631 | $ | (264) |

| Operating revenues | $ | 5,519 | $ | 5,427 | $ | 92 | $ | 10,745 | $ | 10,314 | $ | 431 |

| Operating margin (%) | 8.4 | 14.8 | (6.4) pp | 4.4 | 7.6 | (3.2) pp | ||||||

| Adjusted EBITDA margin (%) | 16.6 | 22.5 | (5.9) pp | 12.7 | 15.8 | (3.1) pp | ||||||

Adjusted Pre-tax Income (Loss)

Adjusted pre-tax income (loss) is used by Air Canada to assess the overall pre-tax financial performance of its business without the effects of foreign exchange gains or losses, net interest relating to employee benefits, gains or losses on financial instruments recorded at fair value, gains or losses on sale and leaseback of assets, gains or losses on disposal of assets, gains or losses on debt settlements and modifications, as these items may distort the analysis of certain business trends and render comparative analysis across periods or to other airlines less meaningful.

Adjusted pre-tax income (loss) is reconciled to GAAP income (loss) before income taxes as follows:

| (Canadian dollars in millions) | Second Quarter | First Six Months | ||||||||||

| 2024 | 2023 | $ Change | 2024 | 2023 | $ Change | |||||||

| Income before income taxes – GAAP | $ | 404 | $ | 796 | $ | (392) | $ | 339 | $ | 773 | $ | (434) |

| Adjusted for: | ||||||||||||

| Foreign exchange (gain) loss | 2 | (251) | 253 | (57) | (378) | 321 | ||||||

| Net interest relating to employee benefits | (6) | (6) | – | (11) | (12) | 1 | ||||||

| (Gain) loss on financial instruments

recorded at fair value |

(29) | 115 | (144) | (40) | 77 | (117) | ||||||

| Loss on debt settlement | – | 2 | (2) | 46 | 2 | 44 | ||||||

| Adjusted pre-tax income | $ | 371 | $ | 656 | $ | (285) | $ | 277 | $ | 462 | $ | (185) |

Adjusted Net Income (Loss) and Adjusted Earnings (Loss) Per Share – Diluted

Air Canada uses adjusted net income (loss) and adjusted earnings (loss) per share – diluted as a means to assess the overall financial performance of its business without the after-tax effects of foreign exchange gains or losses, net financing expense relating to employee benefits, gains or losses on financial instruments recorded at fair value, gains or losses on sale and leaseback of assets, gains or losses on debt settlements and modifications, gains or losses on disposal of assets as these items may distort the analysis of certain business trends and render comparative analysis to other airlines less meaningful.

Adjusted net income (loss) and adjusted earnings (loss) per shares are reconciled to GAAP net income as follows:

| (Canadian dollars in millions) | Second Quarter | First Six Months | ||||||||||

| 2024 | 2023 | $ Change | 2024 | 2023 | $ Change | |||||||

| Net income – GAAP | $ | 410 | $ | 838 | $ | (428) | $ | 329 | $ | 842 | $ | (513) |

| Adjusted for: | ||||||||||||

| Foreign exchange (gain) loss | 2 | (251) | 253 | (57) | (378) | 321 | ||||||

| Net interest relating to employee benefits | (6) | (6) | – | (11) | (12) | 1 | ||||||

| (Gain) loss on financial instruments

recorded at fair value |

(29) | 115 | (144) | (40) | 77 | (117) | ||||||

| Loss on debt settlement | – | 2 | (2) | 46 | 2 | 44 | ||||||

| Income tax, including for the above reconciling items (1) |

(8) | (34) | 26 | 6 | (55) | 61 | ||||||

| Adjusted net income | $ | 369 | $ | 664 | $ | (295) | $ | 273 | $ | 476 | $ | (203) |

| Weighted average number of outstanding shares used in computing diluted income per share (in millions) |

376 | 358 | 18 | 376 | 358 | 18 | ||||||

| Adjusted earnings per share – diluted | $ | 0.98 | $ | 1.85 | $ | (0.87) | $ | 0.73 | $ | 1.33 | $ | (0.60) |

| (1) | In 2024, the deferred income tax recovery recorded in other comprehensive income related to remeasurements on employee benefit liabilities is offset by a deferred income tax expense which was recorded through Air Canada’s consolidated statement of operations. This expense is removed from adjusted net income for the year 2024. In comparison, a deferred tax recovery was removed from adjusted net income for the second quarter of 2023. |

The table below reflects the share amounts used in the computation of basic and diluted earnings per share on an adjusted earnings per share basis:

| (In millions) | Second Quarter | First Six Months | ||

| 2024 | 2023 | 2024 | 2023 | |

| Weighted average number of shares outstanding – basic |

358 | 358 | 358 | 358 |

| Effect of dilution | 18 | – | 18 | – |

| Weighted average number of shares outstanding – diluted |

376 | 358 | 376 | 358 |

Free Cash Flow

Air Canada uses free cash flow as an indicator of the financial strength and performance of its business, indicating the amount of cash Air Canada can generate from operations and after capital expenditures. Free cash flow is calculated as net cash flows from operating activities minus additions to property, equipment, and intangible assets, and is net of proceeds from sale and leaseback transactions.

The table below reconciles free cash flow to net cash flows from (used in) operating activities for the periods indicated.

| Second Quarter | First Six Months | |||||||||||

| (Canadian dollars in millions) | 2024 | 2023 | $ Change | 2024 | 2023 | $ Change | ||||||

| Net cash flows from operating activities | $ | 924 | $ | 1,490 | $ | (566) | $ | 2,516 | $ | 2,927 | $ | (411) |

| Additions to property, equipment, and intangible assets |

(473) | (525) | 52 | (1,009) | (975) | (34) | ||||||

| Free cash flow (1) | $ | 451 | $ | 965 | $ | (514) | $ | 1,507 | $ | 1,952 | $ | (445) |

Net Debt

Net debt is a capital management measure and a key component of the capital managed by Air Canada and provides management with a measure of its net indebtedness.

Net Debt to Trailing 12-Month Adjusted EBITDA (Leverage Ratio)

Net debt to trailing 12-month adjusted EBITDA ratio (also referred to as “leverage ratio”) is commonly used in the airline industry and is used by Air Canada as a means to measure financial leverage. Leverage ratio is calculated by dividing net debt by trailing 12-month adjusted EBITDA.

The table below reconciles leverage ratio to Air Canada’s debt net balances as at the dates indicated.

| (Canadian dollars in millions) | June 30, 2024 | December 31, 2023 | Change | |||

| Total long-term debt and lease liabilities | $ | 10,858 | $ | 12,996 | $ | (2,138) |

| Current portion of long-term debt and lease liabilities | 1,619 | 866 | 753 | |||

| Total long-term debt and lease liabilities (including current portion) |

12,477 | 13,862 | (1,385) | |||

| Less cash, cash equivalents and short- and long-term investments |

(8,869) | (9,295) | 426 | |||

| Net debt (1) | $ | 3,608 | $ | 4,567 | $ | (959) |

| Adjusted EBITDA (trailing 12 months) | $ | 3,718 | 3,982 | (264) | ||

| Net debt to adjusted EBITDA ratio (1) | 1.0 | 1.1 | (0.1) | |||

For further information on Air Canada’s public disclosure file, including Air Canada’s 2023 Annual Information Form, dated March 4, 2024, consult SEDAR at www.sedarplus.ca.