Source: American Airlines

American Airlines Group Inc. reported its fourth-quarter and full-year 2024 financial results, including:

American Airlines Group Inc. reported its fourth-quarter and full-year 2024 financial results, including:

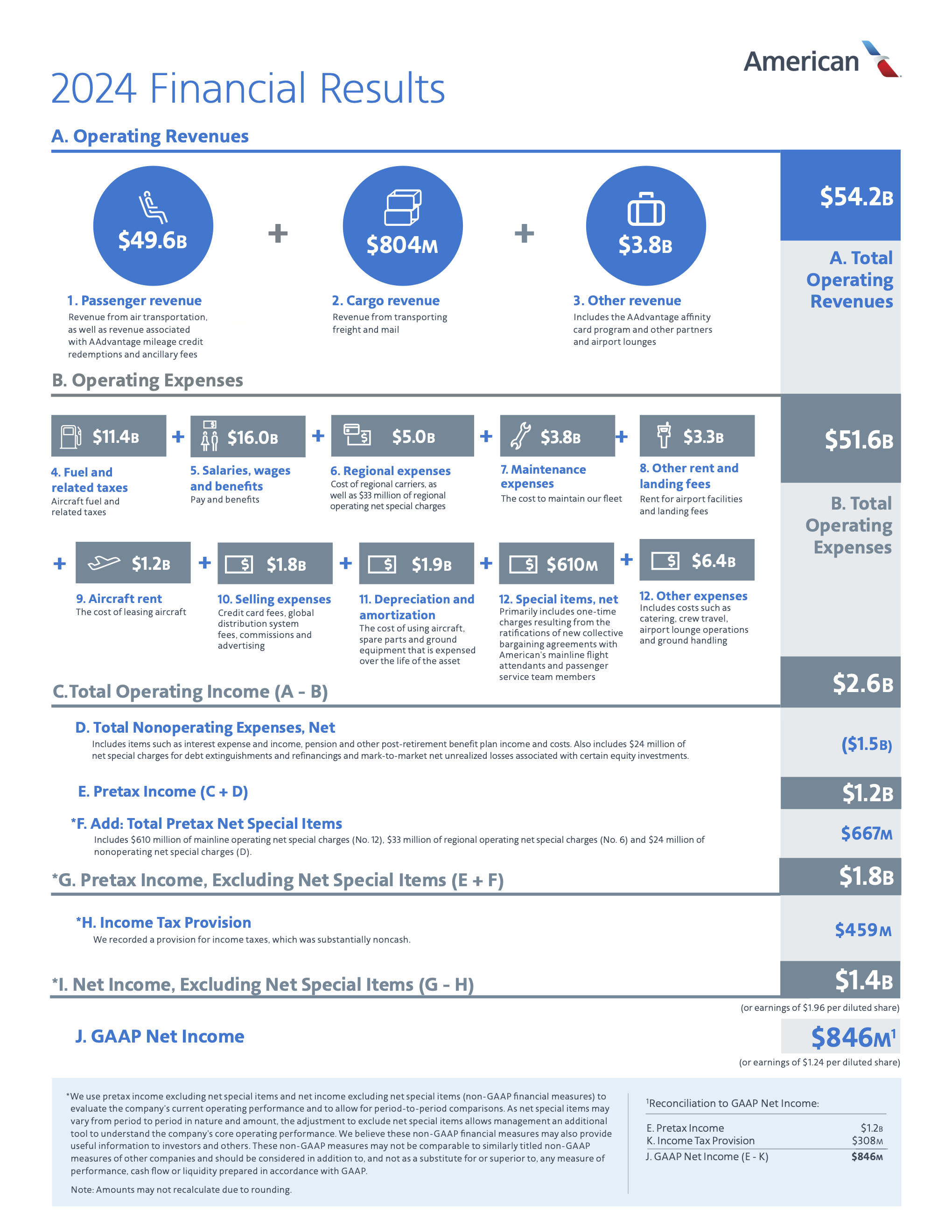

- Record fourth-quarter revenue of $13.7 billion and record full-year revenue of $54.2 billion

- Fourth-quarter and full-year GAAP net income of $590 million and $846 million, or $0.84 and $1.24 per diluted share, respectively

- Excluding net special items1, fourth-quarter and full-year net income of $609 million and $1.4 billion, or $0.86 and $1.96 per diluted share, respectively

- Generated $4 billion in full-year operating cash flow and record full-year free cash flow2 of $2.2 billion

- Announced an exclusive 10-year co-branded credit card partnership with Citi, which is expected to unlock even more value for AAdvantage® co-branded and Citi-branded cardmembers

- Achieved total debt3 reduction goal of $15 billion from peak levels — a full year ahead of schedule

“The American Airlines team achieved a number of important objectives in 2024,” said American’s CEO Robert Isom. “We continue to run a reliable operation, and we are reengineering the business to build an even more efficient airline. That, coupled with our commercial actions, resulted in strong financial performance in the fourth quarter. As we look ahead to this year, American remains well-positioned because of the strength of our network, loyalty and co-branded credit card programs, fleet and operational reliability, a nd the tremendous work of our team.”

Revenue performance

American produced record fourth-quarter and full-year revenue of $13.7 billion and $54.2 billion, respectively. This revenue performance was driven by the actions the airline took to adjust capacity, combined with continued demand strength. Total unit revenue inflected positive in the quarter, up 2.0% versus 2023. In the fourth quarter, American’s year-over-year Domestic, Atlantic, Pacific and total passenger unit revenue results led U.S. network carriers.

Citi partnership

In December, American and Citi announced a new 10-year agreement, with Citi becoming the exclusive issuer of the AAdvantage® co-branded credit card portfolio in the U.S. starting in 2026. The new agreement is expected to drive incremental value for both companies and produce a significantly expanded loyalty and rewards ecosystem for AAdvantage® members and Citi-branded cardmembers alike. Cash remuneration from co-branded credit cards and other partners was $6.1 billion in 2024, an increase of 17.0% versus 2023. Cash remuneration in 2024 included a one-time cash payment related to the new co-branded credit card agreement announced in December. This one-time payment will be amortized over the life of the new agreement beginning in 2026, and therefore had no impact on American’s revenue or earnings in 2024.

Operational performance

The American Airlines team continues to deliver strong operational results, despite the extreme weather and other challenges the airline faced in the quarter and throughout the year. In the fourth quarter, American ranked second in completion factor and on-time departures among the four largest U.S. carriers. For the year, American achieved its second-best completion factor since the merger of American and US Airways, on its largest volume of passengers ever. The team continues to demonstrate its operational resilience and ability to recover from disruptions. Continued investment in the operation and technology that supports it will drive further improvements in the company’s operating reliability and resiliency.

Financial performance

American delivered fourth-quarter and full-year earnings results ahead of its prior guidance. On a GAAP basis, the company produced an operating margin of 8.3% in the quarter and 4.8% for the full year. Excluding the impact of net special items1, the company produced an adjusted operating margin of 8.4% in the quarter and 6.0% for the full year.

Balance sheet and liquidity

In 2024, American generated record free cash flow2 of $2.2 billion, which enabled further strengthening of its balance sheet. In the fourth quarter of 2024, American achieved its total debt3reduction goal of $15 billion from peak levels in mid-2021 — a full year ahead of schedule. The company remains focused on debt reduction as it works toward its stated credit ratings goal of BB. American ended the year with $10.3 billion of total available liquidity, comprised of cash and short-term investments plus undrawn capacity under revolving credit and other facilities.

Guidance and investor update

Based on present demand trends, the current fuel price forecast and excluding the impact of special items, the company expects its first-quarter 2025 adjusted loss per diluted share4 to be between ($0.20) to ($0.40). The company expects its full-year 2025 adjusted earnings per diluted share4 to be between $1.70 to $2.70.

For additional financial forecasting detail, please refer to the company’s investor update, furnished with this press release with the SEC on Form 8-K. This filing is also available at aa.com/investorrelations.

Conference call and webcast details

The company will conduct a live audio webcast of its financial results conference call at 7:30 a.m. CT today. The call will be available to the public on a listen-only basis at aa.com/investorrelations. An archive of the webcast will be available through Feb. 23.

Notes

See the accompanying notes in the financial tables section of this press release for further explanation, including a reconciliation of all GAAP to non-GAAP financial information and the calculation of free cash flow.

- The company recognized $19 million of net special items in the fourth quarter after the effect of taxes, which included a $33 million non-cash write down of regional aircraft resulting from the decision to permanently park 43 Embraer 145 aircraft. The company recognized $516 million of net special items in 2024 after the effect of taxes, which included operating net special items of $643 million principally related to one-time charges resulting from the ratifications of new collective bargaining agreements with the airline’s mainline flight attendants and passenger service team members.

- Please see the accompanying notes for the company’s definition of free cash flow, a non-GAAP measure.

- All references to total debt include debt, finance and operating lease liabilities and pension obligations.

- Adjusted earnings per diluted share guidance excludes the impact of net special items. The company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time.

Financial results

Click the button below to download the fourth-quarter and full-year 2024 financial results.