Source: ALTA

- The international air market within Latin America experienced the highest growth in May and has been the most dynamic since the post-pandemic period

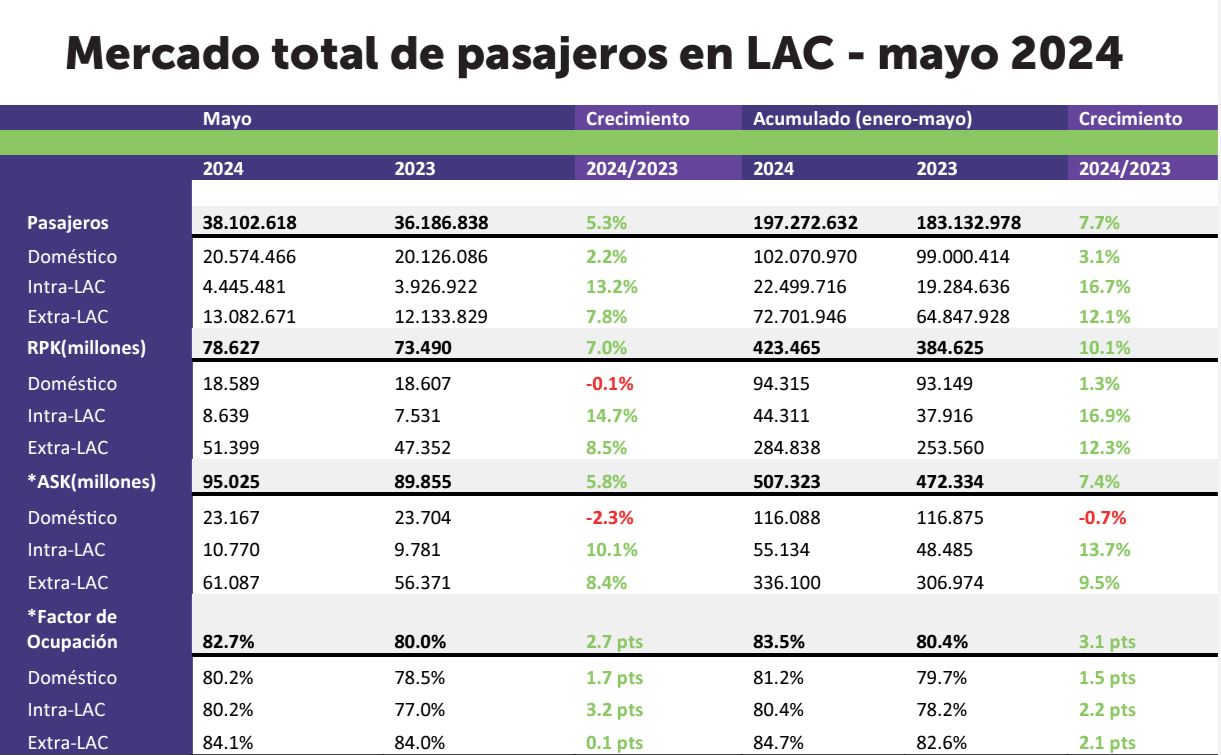

The intraregional international market, encompassing international travel within Latin America and the Caribbean (LAC), experienced the highest percentage growth in May 2024 compared to domestic and extraregional international travel. This market reached 4.45 million passengers, a 13.2% increase compared to May 2023.

From January to May, the intraregional international market also recorded the highest percentage growth, with an increase of nearly 17%. It is noteworthy that this segment was the only one that had not surpassed pre-pandemic levels until July 2023. Additionally, it showed a 6% growth compared to 2019 during this month.

This growth reflects a robust recovery and a rising demand for connections within the region, highlighting significant growth potential.

“These are significant achievements that demonstrate the essential role of aviation in our region, the industry’s resilience, and the work of thousands of men and women. The substantial contribution of this sector to the population’s life still holds enormous potential, which is why we urge governments to include aviation in their state agendas,” emphasizes José Ricardo Botelho, Executive Director and CEO of ALTA.

The report specifies that in May 2024, passenger traffic to, from, and within Latin America and the Caribbean increased by 5.3%, mobilizing 38.1 million people, 1.9 million more than in May 2023. Between January and May, 197.2 million passengers were transported, an 8% increase compared to the previous year.

From January to May 2024, 197.2 million passengers were transported to, from, and within the region, an 8% growth in total demand, measured in revenue passenger kilometers (RPK), which grew by 7%. Once again, the intraregional segment stood out with a 14.7% increase.

The domestic markets of Colombia and Peru, along with traffic between Mexico and the United States, accounted for more than 50% of the total growth, adding 1.07 million passengers to the region. In percentage terms, Venezuela and Costa Rica excelled with increases of 37% and 19%, respectively, according to the report.

Half of the region’s total traffic was in the extraregional segment, which grew by 7.8%, reaching 13 million passengers. This growth was primarily driven by the Costa Rica-United States (+26%) and Panama-United States (+22%) markets, with 5,675 additional flights between North America and the region.

Similarly, in the extraregional segment, key North American and European markets reached their highest capacity since 2019 this May. Traffic between Latin America and Europe increased by 9%, with 828 additional flights. Traffic between Latin America and Africa also showed great dynamism, with a 72% increase and 88 additional frequencies.

Colombia leads domestic traffic for a second month in a row

Total domestic traffic in the region increased 2.2%, reaching 20.6 million passengers. Colombia led domestic traffic in LAC for a second month in a row, with a 20% increase in passengers. It was also the domestic market with the largest increase in absolute terms, reaching 449,000 additional passengers.

Chile, Venezuela and Panama also showed increases in their domestic traffic, while Brazil, Mexico and Argentina recorded a decrease.

In particular, Chile increased 5.8% to 1.2 million passengers. Venezuela increased 21%, carrying 196,472 passengers, and Panamanian domestic traffic grew by 38% reaching 31,125 passengers.

Brazil, Mexico and Argentina did not perform as well. Brazil mobilized 7.2 million passengers and recorded 61,600 flights, down 1.6% and 6%, respectively, vs. May 2023.

In Mexico, domestic traffic remained 1% below 2023 levels. However, this month recorded the highest domestic traffic in the country, with 5.2 million passengers, 34,000 fewer than the previous year.

In Argentina, domestic traffic was down 23.2% for a second month in a row, equivalent to 138,000 fewer passengers than in May 2023, with a total of 1.3 million passengers and a 21% drop in domestic frequencies, representing 2,228 fewer flights. This decline is partially caused by a 274,000 passenger decrease at Aeroparque airport, which accumulated almost 40% of domestic traffic, with a 26% reduction.

“For some domestic markets we see how the political environment, unilateral decisions and economic and social strains affect the growth and good performance of industries such as aviation, whose operations are subject to fuel price changes and currency exchange rate adjustments, to name two elements. Everything is linked; therefore, the public-private sector must work closely for the benefit of our economies”, Botelho explains.