Source: American Airlines

American Airlines Group Inc. (NASDAQ: AAL) today reported its first-quarter 2025 financial results, including:

American Airlines Group Inc. (NASDAQ: AAL) today reported its first-quarter 2025 financial results, including:

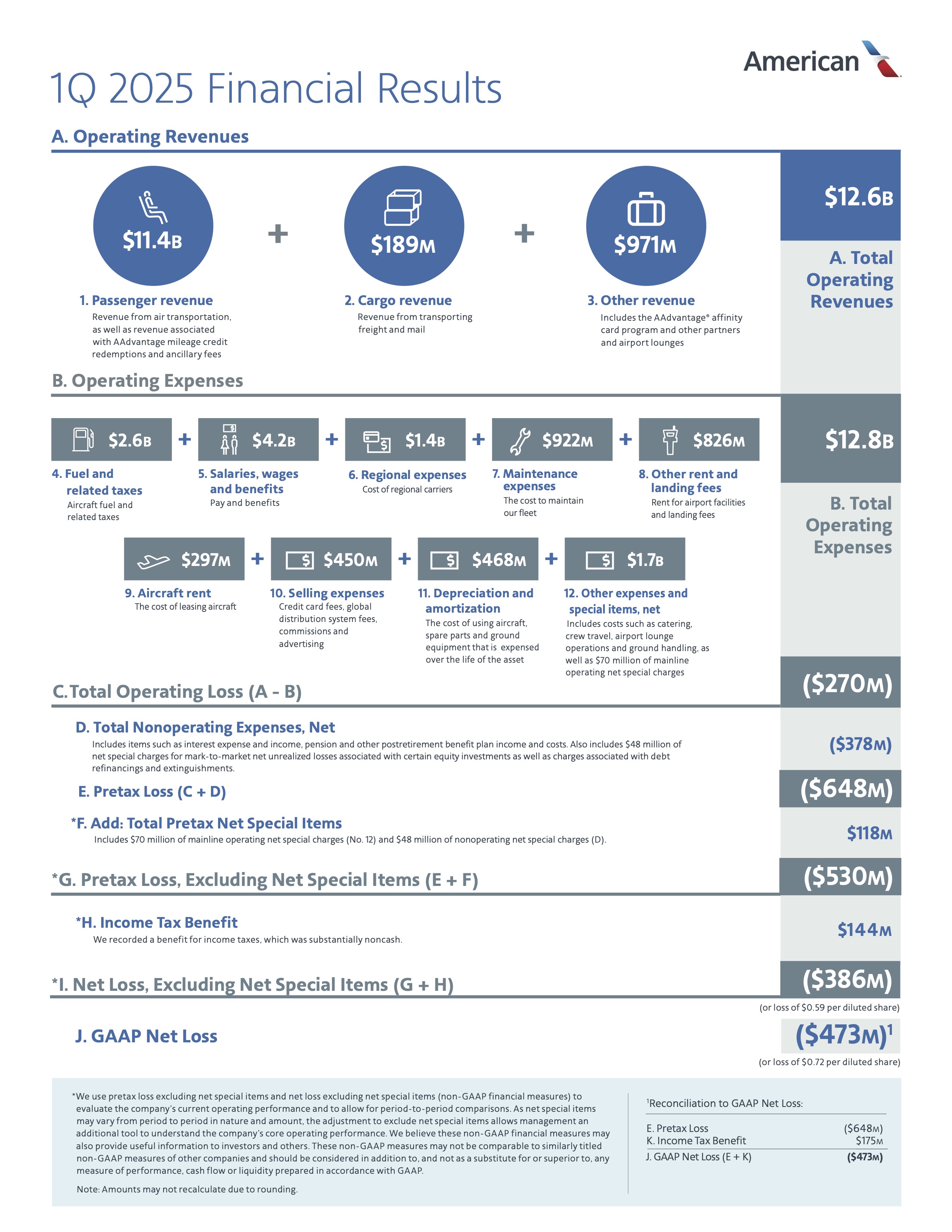

- First-quarter revenue of $12.6 billion

- First-quarter GAAP net loss of $473 million, or ($0.72) per diluted share

- Excluding net special items1, first-quarter net loss of $386 million, or ($0.59) per diluted share

- Ended the quarter with $10.8 billion of total available liquidity

“The actions American has taken over the past several years to refresh our fleet, manage costs and strengthen our balance sheet position us well for the uncertainty our industry is facing,” said American’s CEO Robert Isom. “The resiliency of the American Airlines team, combined with the investments we have made to differentiate our network, product and customer experience, give us extreme confidence in our ability to navigate the current environment and deliver strong results for the long term.”

Revenue performance

American produced first-quarter revenue of $12.6 billion. Total unit revenue was up 0.7% versus the first quarter of 2024, driven by continued strength in international unit revenue, which was up 2.9% year over year on 0.8% lower capacity year over year, and continued growth in premium and loyalty revenue. Throughout the quarter, American continued to restore revenue in indirect channels and remains on track to restore its revenue share from indirect channels to historical levels exiting the year. These efforts were offset by a number of factors, including economic uncertainty that pressured domestic leisure demand and the tragic accident of American Eagle Flight 5342.

AAdvantage® and Citi partnership

American and Citi continue to work toward the implementation of their exclusive and expanded partnership, which starts in 2026, and American remains on track to achieve the long-term growth targets the company previously outlined. In the first quarter, AAdvantage® enrollments were up 6% year over year with spending on the airline’s co-branded credit cards up 8% year over year, underscoring the continued value of American’s loyalty program.

Customer experience

American’s strong operational performance in recent years and its updated commercial strategy puts the airline in position to renew its focus on the customer experience to drive additional revenue growth. American has established a new Customer Experience organization to drive the strategy and coordinate the implementation of initiatives that define customers’ journeys with American. The company recently announced complimentary high-speed satellite Wi-Fi for AAdvantage® members beginning in January 2026, sponsored by AT&T. With this, American will offer free inflight connectivity on more aircraft than any other carrier.

Operational performance

In the first quarter, the American team continued to demonstrate its operational resilience and ability to quickly recover from disruptions. American continues to invest in its operation, team and technology to drive additional enhancements in operational reliability.

Financial performance

In the first quarter, the company produced an operating margin of (2.2%) on a GAAP basis. Excluding the impact of net special items1, the company produced an adjusted operating margin of (1.6%) in the quarter.

Balance sheet and liquidity

American generated free cash flow2 of $1.7 billion in the first quarter, which enabled further strengthening of its balance sheet. In the quarter, American reduced its total debt3 by $1.2 billion, contributing to total debt reduction of $16.6 billion from peak levels in 2021. The airline has positioned its balance sheet well for the current environment and remains committed to reducing total debt to less than $35 billion by year-end 2027. The airline ended the first quarter with $10.8 billion of total available liquidity, comprised of cash and short-term investments plus undrawn capacity under revolving credit and other facilities. American has available borrowing capacity of more than $10 billion in unencumbered assets and more than $13 billion in additional first-lien borrowings allowable by its existing financing arrangements.

Guidance and investor update

Based on present demand trends, the current fuel price forecast and excluding the impact of special items, the company expects its second-quarter 2025 adjusted earnings per diluted share4 to be between $0.50 and $1.00. The company is withdrawing its full-year guidance at this time. American intends to provide a full-year update as the economic outlook becomes clearer.

For additional financial forecasting detail, please refer to the company’s investor update, furnished with this press release with the SEC on Form 8-K. This filing is also available at aa.com/investorrelations.

Notes

See the accompanying notes in the financial tables section of this press release for further explanation, including a reconciliation of all GAAP to non-GAAP financial information and the calculation of free cash flow.

-

The company recognized $87 million of net special items in the first quarter after the effect of taxes, which included operating net special items of $70 million. The first quarter net special items included a one-time charge resulting from pay rate increases effective Jan. 1, 2025, related to the ratification of the contract extension reached in the fourth quarter of 2024 with the company’s mainline maintenance and fleet service team members and an adjustment to litigation reserves, as well as nonoperating net special items of $48 million related to mark-to-market net unrealized losses associated with certain equity investments as well as charges associated with debt refinancings and extinguishments.

-

Please see the accompanying notes for the company’s definition of free cash flow, a non-GAAP measure.

-

All references to total debt include debt, finance and operating lease liabilities and pension obligations.

-

Adjusted earnings per diluted share guidance excludes the impact of net special items. The company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time.