Source: ALTA

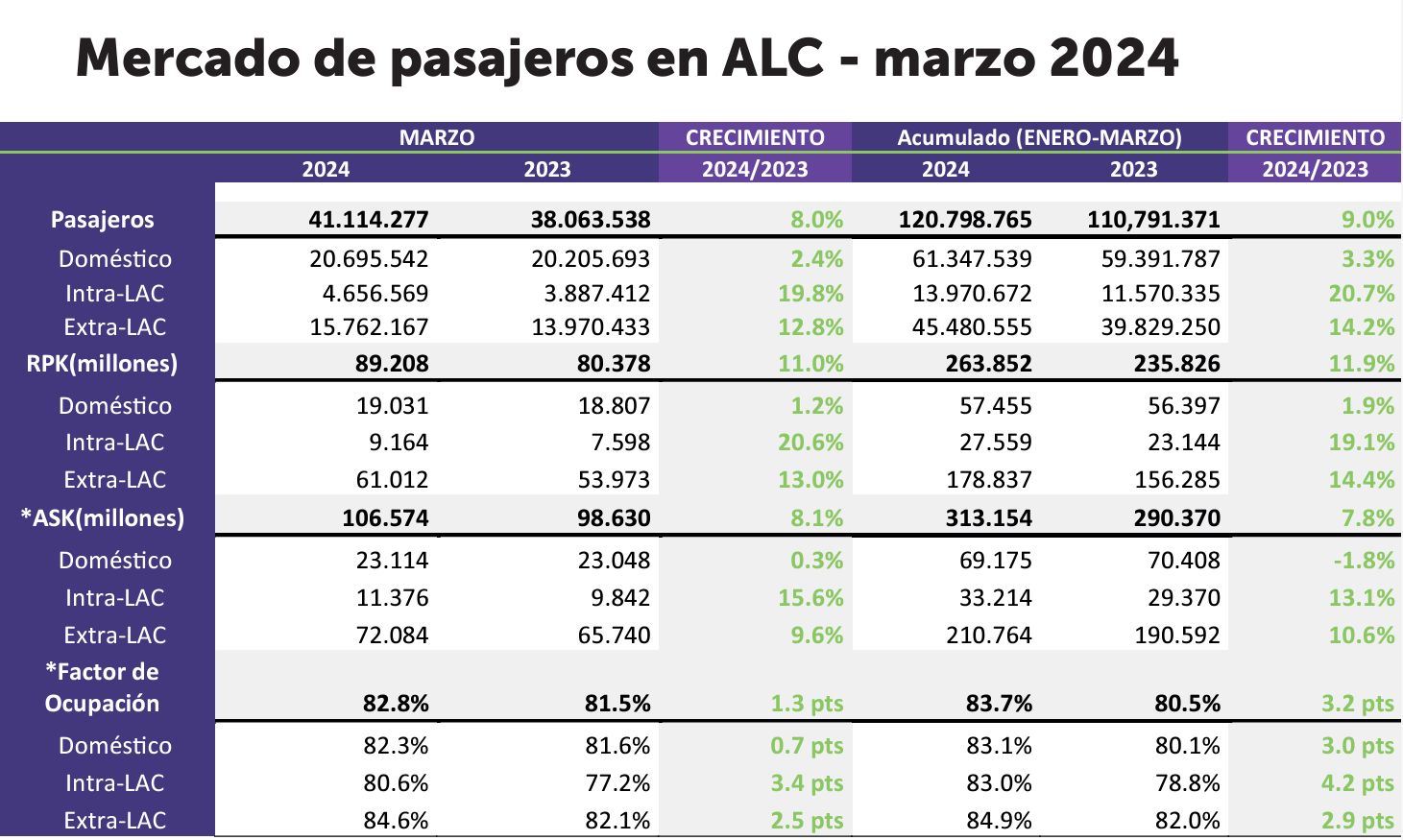

- In March, according to the Passenger Traffic Report released by the Latin American and Caribbean Air Transport Association (ALTA), the region carried 41.1 million people, marking an increase of 8%, with 3.05 million more passengers than in March 2023.

During the first three months of this year, there was a 9% increase in total air passenger traffic, registering an increase of 10 million travelers compared to the same period in 2023. The markets of Colombia, Chile, Peru and Brazil stood out as the main drivers of this net growth, contributing a total of 4.6 million additional passengers.

In March, according to the Passenger Traffic Report released by the Latin American and Caribbean Air Transport Association (ALTA), the region carried 41.1 million people, marking an increase of 8%, with 3.05 million more passengers than in March 2023. Brazil, Colombia and Peru played significant roles in this growth, contributing more than 1.5 million passengers, with Colombia being the main driver, responsible for 26% of the total increase.

“The market outlook reinforces the promising trend observed in March: the domestic market recorded growth of 2.4%, while the international market stood out with a significant increase of 14%,” emphasizes José Ricardo Botelho, ALTA’s executive director and CEO. “These figures show a continuous increase in demand. Looking at the first quarter of this year, we see that 120.8 million passengers flew, representing an increase of 9% compared to the same period in 2023. Aviation is no longer a luxury but an essential means of transportation for the population,” added Botelho.

Mexico’s domestic market is in decline

In March, the Brazilian domestic market handled 7.5 million passengers, an increase of 1% on the previous year. The route between Brasília (BSB) and São Paulo (CGH) was the fastest growing, with 13% more travelers, while the busiest route, São Paulo (CGH) – Rio de Janeiro (SDU), saw a 5% reduction in passenger volume.

In Colombia, domestic passenger traffic grew by 9.3%, reaching 2.6 million passengers. Of particular note was the route between Bogotá (BOG) and Pereira (PEI), which saw a 58% increase, totaling 1,264 flights in March. In addition, during this month, the country experienced a significant increase in seat capacity in the domestic market.

In Mexico, domestic traffic fell by 7%, totaling 4.9 million passengers. However, the route between St. Lucia (NLU) and Cancún saw growth of 56%.

In Argentina, there was moderate growth of 1% in the domestic market, while in Chile the increase was 6%, with the route between Calama (CJC) and La Serena (LSC) standing out with an increase of 57%.

Both Venezuela and Panama also showed significant increases in domestic traffic, up 30% and 52% respectively.

Colombia and Venezuela’s international market is taking off

In March 2024, there was growth in international air traffic in several Latin American countries. Colombia led the way with a 32.3% increase, carrying 1.8 million passengers. Brazil also saw a significant increase of 22%, totaling 2.01 million travelers during the month. In addition, the Dominican Republic experienced a 13% increase in its international traffic, reaching the 1.8 million passenger mark.

Mexico saw a 12% increase in the number of international passengers, while Argentina and Chile witnessed growth of 17% and 24% respectively. However, it was Venezuela that led international growth with an impressive 68% increase.

Year-to-date, Venezuela stands out with a 60% increase in traffic. “This figure is extremely important, but we recognize that, in absolute terms, there is still room for improvement. That’s why ALTA is collaborating with local authorities to promote more effective measures aimed at boosting the country’s airline sector,” said Botelho.

ALTA’s CEO reiterates that it is essential that the region’s governments recognize the strategic importance of the aviation sector and promote close collaboration to ensure the sustainable growth of an essential sector. Greater investment in infrastructure and efficient regulation are needed to promote competitiveness and operational efficiency.